REGISTER NOW TO START TRADING

TRY US WITHOUT RISK

You take the profits, We cover possible losses, On your first 5 trades.

HOT OPPORTUNITIES

Check how much you could earn on

Enter your investment Amount

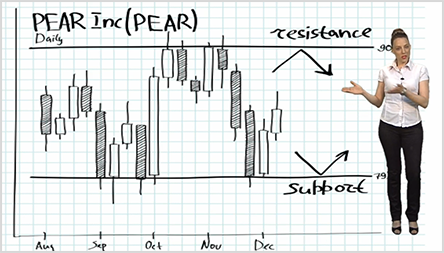

COURSES FOR ALL SKILL LEVELS

SEE WHAT OTHERS ARE TRADING

FIND OUT WHAT’S HOT, AND WHAT’S NOT.

Here you can see what other traders are thinking and investing. This great tool can help you catch early trends in the markets and act accordingly. Will you follow the trend or go in the opposite direction?

MARKET UPDATES

TRADE ON THE GO

Trade on your smartphone or tablet with our brand new mobile trading app. Never again miss the opportunity to earn when you are not at home. Access your account information, investment portfolio and market analysis at any time. Download the free A3 Trading app now.

WHY TRADE ONLINE?

Online trading is absolutely the best way to earn significant profits from investment in the short term. All you need to get started is an internet connection and the desire to learn how to trade. Unlike other forms of investment, you don't need large amounts of money to get started. You can start with as little as $200.